You are here: Home / Additional modules / Billing / Basic settings

€

Billing

Basic settings

Inhaltsverzeichnis

In the basic settings for the billing module, the various settings such as document texts, payment types, invoice numbers, payment targets and discounts can be entered.

This is a prerequisite for working with the billing module. To the right of the settings, a check mark indicates when the configuration is correct. All settings must be set up correctly.

On the tab Invoice in the basic settings under Tools >> Settings >> Basic Settings >> Tab Invoice you will find the categories Document Texts, Templates, Advanced Settings and Automation, which will be explained in the following.

The document texts are pre-filled with meaningful texts at the start, suitable standard templates are set for templates and the settings are configured. These can be adapted for individualized work.

Document texts

Texts for invoices and credit notes for the payment types bank transfer, SEPA direct debit, credit card and other can be stored under the document texts.

The texts can be entered multilingually for the languages you have activated. They are then inserted depending on the language of the contact.

The various payment type texts can then be output in the document by macro. The macro list contains a description of all billing macros.

In the Tax liability area, you enter the texts for the various tax liabilities.

Depending on the payment type set in the contact and the document type, the appropriate document text is displayed in the document.

Templates

In the category Templates you can store an invoice template and an invoice correction/credit note template each as PDF and Email. The PDF and Email letter templates created with the category ‘Invoice template’ in the template management are available for selection.

These templates are used for the automatic creation or automatic dispatch of documents. When documents are generated manually, they are proposed.

In addition, a default sender for billing documents must be set for automatic dispatch .

Advanced settings

In the advanced settings you can define settings for posting accounts, invoice numbers, credit note numbers, payment terms and discounts, currency, tax rates and SEPA creditor ID.

Posting accounts:

Under Posting accounts you can enter your posting accounts. Via “Add account” you can create a new account.Via the edit pen at the individual accounts you can edit the account data. Account name, bank name, IBAN and BIC can be entered for each posting account. The validity of the IBAN is checked in the process. The bank data will be pre-entered under “Extras >> Settings >> Basic settings >> Imprint”. The fields “Bank name”, “IBAN” and “BIC” must be either all filled or all empty.

The trash can icon allows you to delete an account if the account has not yet been linked to any transaction or document.

As usual, the account list can be sorted by the columns. You can use the scroll icons at the bottom right to scroll if there are many accounts.

Using the Faktura-Makros _FakturaKontoIBAN, _FakturaKontoBIC, _FakturaKontoBankname and _FakturaKontoname for the posting accounts, you can output this information in the documents. A booking account must be specified for each booking.

Invoice Number:

Here you can adapt the appearance of the invoice number to your wishes. The selection “Counter” must be selected at least once so that the invoice number can also be created consecutively. The counter start number can be edited only by users who have the corresponding right (User settings, “Rights” tab, category “Invoice”). When configuring the meter, the relevant regulations and rules (e.g. GoBD) must be observed. An invoice number cannot be assigned twice. Each time an invoice is created, the invoice number is incremented by one.

Credit Memo Number:

Equivalent to the invoice number you configure the credit note number here.

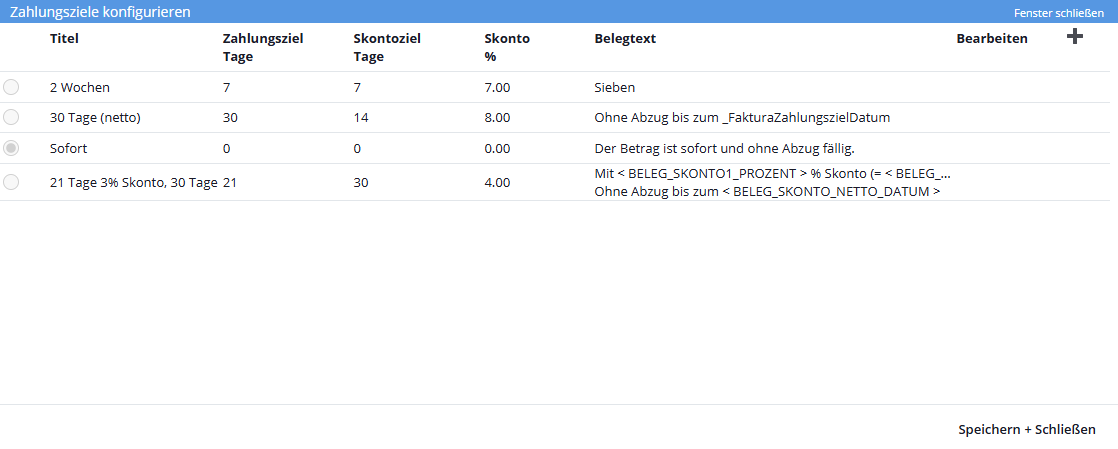

Payment terms and discounts

In the popup for payment terms and cash discount, you enter the desired payment terms as well as cash discount terms and the cash discount percentage rate. Under Document text you enter the corresponding text, billing macros can be used here.

You can create a new payment term by clicking on the + symbol at the top right. Editing or deleting is done via the mouse-over icons at the payment target.

Via the language selector at the bottom left, document texts for the payment terms can be created in different languages. The other data of the payment terms are the same in all languages. Depending on the language of the contact, the payment term including the document text can then be displayed in documents.

Tax rates

There are 3 different tax rates preconfigured, “Tax free”, “Reduced tax” and “Full tax”. However, the title and tax rate can also be customized to suit your needs.

The tax rates configured here define the tax rate of an item group .

Currency

The currency € is permanently displayed, it cannot be changed.

SEPA Creditor Id:

The SEPA Creditor Id can be set here. A merchant must have a Creditor Identifier to be able to collect SEPA direct debits from payers. A Creditor Identifier is a unique identifier that identifies each SEPA Direct Debit Creditor. If an contact has the payment type “direct debit”, a SEPA Creditor ID must be stored. Otherwise, no postings or documents can be made for these contacts.

Responsibility Invoice Release:

If the field “Release invoice” is activated in the administration under Input fields >> Contact management >> Invoice , the value for invoice creation and dispatch must be set to “Yes”.

Without the “Release Invoices” user right , “Release Invoice” is set to “No” as soon as changes are made to invoice-relevant fields . As a result, a task is automatically sent to the user or group selected here.

Automation

Send invoice automatically by Email:

Automatically created invoices are sent directly by Email to the billing contact stored in the contact. Requirements A default sender for billing documents must be set in Basic Settings >> Billing >> Templates. A billing contact must be stored in the contacts under Email.

Entry

Entry Dashboard

Dashboard Contacts

Contacts Properties

Properties Email

Email Calendar

Calendar Tasks

Tasks Acquisition Cockpit

Acquisition Cockpit Audit-proof mail archiving

Audit-proof mail archiving Automatic brochure dispatch

Automatic brochure dispatch Billing

Billing Groups

Groups Intranet

Intranet Marketing Box

Marketing Box Multi Property module

Multi Property module Multilingual Module

Multilingual Module onOffice sync

onOffice sync Presentation PDFs

Presentation PDFs Process manager

Process manager Project Management

Project Management Property value analyses

Property value analyses Enquiry Manager

Enquiry Manager Showcase TV

Showcase TV Smart site 2.0

Smart site 2.0 Statistic Tab

Statistic Tab Statistics toolbox

Statistics toolbox Success Cockpit

Success Cockpit Time Tracking

Time Tracking Address from clipboard

Address from clipboard Text block

Text block Customer communication

Customer communication External Tools

External Tools Favorite links

Favorite links Calculating with formulas

Calculating with formulas Mass update

Mass update onOffice-MLS

onOffice-MLS Portals

Portals Property import

Property import Quick Access

Quick Access Settings

Settings Templates

Templates Step by step

Step by step